- The High Cost of Open Fields: Indian Agriculture at a Crossroads

- Tables Turned: Can India’s Fields Absorb America’s Overabundance?

- The Shadow of the U.S. Trade Deal on India’s Smallholders

- The $100 Billion Gamble: America’s Surplus, India’s Stress

New Trade Deals: The U.S. recently entered a landmark framework with India, where India has committed to importing $100 billion in U.S. goods annually over five years, including energy and select agricultural products to help vent some of the U.S. surplus.

In 2026, the U.S. agricultural landscape is defined by a paradoxical “oversupply” crisis. While production of staple crops like corn and soybeans remains at near-record levels, the sector is struggling with a widening trade deficit—meaning the U.S. is importing more food than it exports for the third consecutive year. The farm products like cotton, soyabeans, wheat and dry fruits piled up in US.

Agri-crisis in US

The surplus has led to a “generational downturn” in farm income, as the high supply keeps commodity prices low while production costs (fertilizer, labor) remain at record highs in US. Financial Strain: 83% of economists currently classify the row crop sector as being in a recession. Farmer bankruptcies saw a significant uptick through late 2025. Government Aid: The Farmer Bridge Assistance (FBA) program is currently rolling out $12 billion in payments to help producers weather trade disruptions.

Agriculture is silent engine in India

For decades, the Indian farmer has been the silent engine of the nation’s economy, yet recent data paints a sobering picture of their financial health. According to a 2026 report by the Organisation for Economic Cooperation and Development (OECD), Indian farmers have faced a staggering cumulative loss of Rs 111 lakh crore between 2000-01 and 2024-25. This “implicit taxation”—driven by market price fluctuations, lack of infrastructure, and a global economic design that often favors industry over the field—has left the sector in a state of chronic distress.

The 2025 Cotton Crisis

The fragility of this ecosystem was laid bare in 2025. Despite being a major producer, India allowed the import of approximately 30 lakh cotton bales. The influx of cheaper international fiber, particularly from highly subsidized markets, caused domestic cotton prices to crash. Farmers who had invested heavily in seeds and labor saw their returns plummet by Rs 1,000 to Rs 1,500 per quintal, pushing many deeper into a cycle of debt.

The Shadow of the US-India Trade Deal

As we move through 2026, the new interim trade agreement between the U.S. and India has sparked intense debate. On the surface, the deal offers a “calibrated” opening. For India: Zero-tariff access to the U.S. market for spices, fruits, and high-value niche products. For the U.S. Reduced or eliminated tariffs on products like soybean oil, dried distillers’ grains (DDGs), and red sorghum. However, the U.S. agricultural landscape is currently grappling with a massive oversupply crisis. With record-level production of corn and soybeans but a widening trade deficit, the U.S. is aggressively looking for “dumping grounds” to offload surplus.

Impact on Small and Marginal Farmers

- Price Suppression- Market Volatility

The deal creates a “paradox of plenty” that could be devastating for India’s small and marginal farmers, who make up over 80% of the workforce. While the government insists sensitive sectors like dairy are protected, the lowering of duties on soybean oil and feed grains directly threatens the livelihoods of domestic oilseed and maize growers. The U.S. oversupply ensures that global prices remain low. As India opens its doors, even in a “calibrated” manner, domestic prices are likely to be tethered to these depressed global benchmarks.

The Subsidy Imbalance

Unlike U.S. farmers who receive billions in “Bridge Assistance” to survive low-price cycles, Indian farmers lack a comparable safety net, making them far more vulnerable to market shocks. While the deal may benefit the processing industry and poultry sectors by providing cheaper raw materials, it risks further eroding the base of India’s rural economy. Without robust safeguards, the “strategic alignment” with the U.S. may come at the cost of India’s own food sovereignty.

Tailpiece: “New Indian Leader Comes Begging” – This infamous headline appeared in an Alabama newspaper and is often cited by historians as a symbol of the “begging bowl” diplomacy that Indira Gandhi grew to despise in 1970. The same country is appealing India to buy its farm products in 2026.

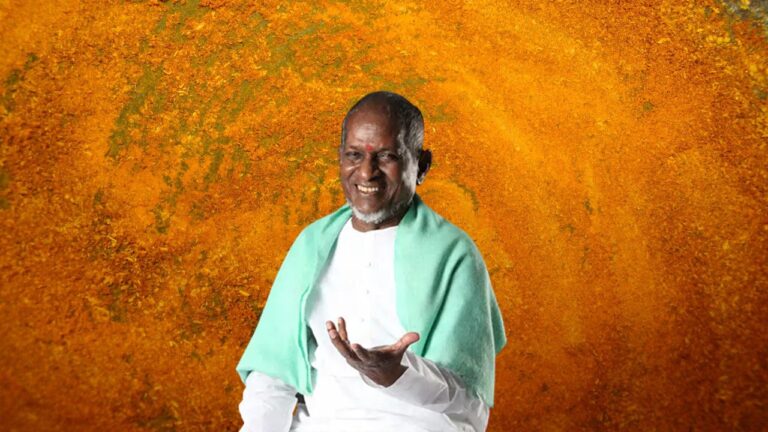

Editor, Prime Post

Ravindra Seshu Amaravadi, is a senior journalist with 38 years of experience in Telugu, English news papers and electronic media. He worked in Udayam as a sub-editor and reporter. Later, he was associated with Andhra Pradesh Times, Gemini news, Deccan Chronicle, HMTV and The Hans India. Earlier, he was involved in the research work of All India Kisan Sabha on suicides of cotton farmers. In Deccan Chronicle, he exposed the problems of subabul and chilli farmers and malpractices that took place in various government departments.